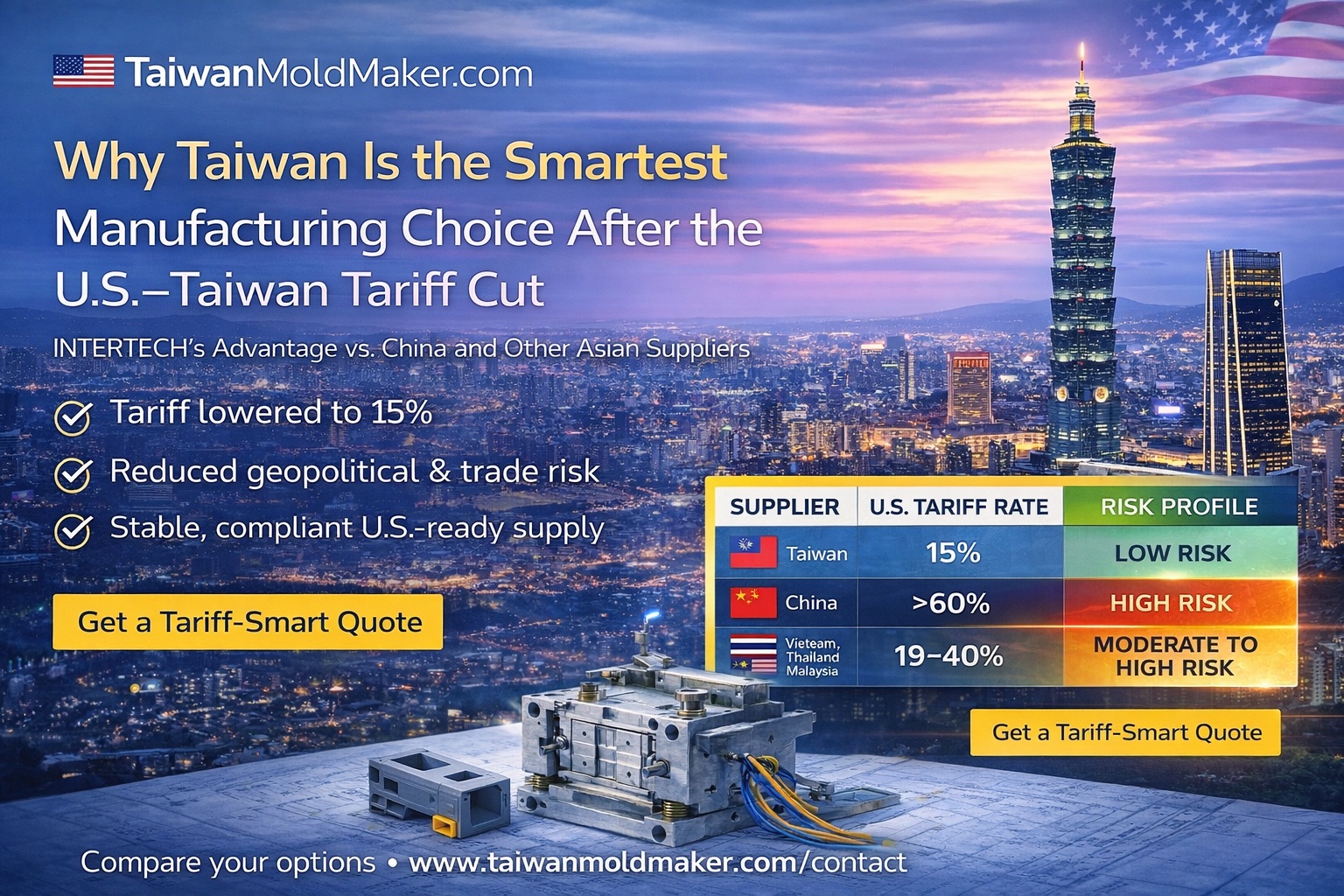

Why Taiwan Is the Smartest Manufacturing Choice After the U.S.–Taiwan Tariff Cut

Why Taiwan Is the Smartest Manufacturing Choice After the U.S.–Taiwan Tariff Cut

Why Taiwan Is the Smartest Manufacturing Choice After the U.S.–Taiwan Tariff Cut

INTERTECH’s Advantage vs. China and Other Asian Suppliers

As global supply chains reset, U.S. buyers are no longer evaluating suppliers on unit price alone. Tariffs, geopolitical risk, delivery reliability, and compliance exposure now play a decisive role in sourcing decisions.

The newly finalized U.S.–Taiwan trade agreement, which reduces reciprocal tariffs on Taiwanese exports from 20% to 15%, positions Taiwan—and manufacturers like INTERTECH—as one of the most competitive and stable sourcing options for the U.S. market.

This article explains why Taiwan now outperforms China and much of Asia for U.S. buyers seeking long-term manufacturing partners.

1. The U.S.–Taiwan Trade Agreement: What Changed and Why It Matters

In May, the U.S. Department of Commerce confirmed a bilateral trade agreement that aligns Taiwan’s export tariff rate to the U.S. at 15%, matching Japan and South Korea.

More importantly, the agreement establishes Taiwan as a preferred supply-chain partner through:

-

USD 500 billion in Taiwanese commitments to U.S. investment

-

Strategic cooperation in semiconductors, AI, energy, and advanced manufacturing

-

Preferential treatment under Section 232 mitigation frameworks for selected industries

For U.S. buyers, this signals policy stability, predictable trade terms, and reduced tariff shock risk—a sharp contrast to sourcing from China or tariff-exposed Southeast Asia.

2. Taiwan vs. China: A Tariff and Risk Reality Check

| Country / Region | Effective U.S. Tariff Outlook | Buyer Risk Profile |

|---|---|---|

| Taiwan | 15% (stable, negotiated) | Low political risk, high transparency |

| Japan / Korea | 15% | Stable, higher cost base |

| Vietnam | 20% (up to 40% for transshipment) | High customs scrutiny |

| Thailand / Malaysia | 19–20% | Limited trade leverage |

| China | 60%+ effective (301, 232, sanctions) | Severe geopolitical & compliance risk |

| India | 25–50% (volatile) | Unpredictable policy exposure |

Unlike China—where 301 penalties, sanctions, and sudden enforcement actions remain unresolved—Taiwan offers U.S. buyers contractual certainty and rule-based trade.

3. Why INTERTECH Benefits Directly from Taiwan’s Tariff Position

INTERTECH operates within Taiwan’s advanced manufacturing ecosystem, allowing U.S. buyers to capture the benefits of the new tariff structure without relocating tooling or redesigning products.

Key advantages include:

-

Tariff parity with Japan and Korea, without their higher labor and tooling costs

-

No transshipment risk, unlike Vietnam or third-party assembly routes

-

Stable country-of-origin compliance, critical for U.S. customs audits

Explore INTERTECH’s tooling and molding capabilities:

→ Injection Mold

→ Molding Services

4. Industry Impact: Where U.S. Buyers Gain the Most

Electronics & High-Tech Components (0% Tariff)

Over 76% of Taiwan’s exports to the U.S. fall under the WTO ITA framework, meaning zero tariff exposure.

This directly benefits:

-

Precision plastic housings

-

Electronic enclosures

-

Connector and device components

Industrial & Mechanical Products (15% Tariff)

For injection-molded parts, tools, and industrial plastics, the reduction from 20% → 15%:

-

Restores price competitiveness vs. Japan/Korea

-

Prevents margin erosion vs. Southeast Asia

-

Keeps landed cost predictable

See how INTERTECH supports complex industrial programs:

→ Custom Mold & Design Maker

5. CFO Perspective: Total Cost of Ownership Beats “Low Unit Price”

U.S. procurement teams increasingly evaluate risk-adjusted cost, not just piece price.

Sourcing from Taiwan with INTERTECH reduces:

-

Tariff escalation risk

-

Tool relocation costs

-

Production disruption probability

-

Compliance and re-audit expenses

In contrast, China-based sourcing carries:

-

Sudden tariff spikes

-

Export controls

-

Customs detentions

-

Contract enforceability challenges

This makes Taiwan a defensive sourcing strategy with offensive ROI upside.

6. Supply Chain Resilience Without Requalification

INTERTECH enables U.S. buyers to:

-

Maintain single-source tooling control

-

Scale production without changing country of origin

-

Support dual-plant strategies across Taiwan and Southeast Asia without China exposure

View real-world programs:

→ Customer Examples

7. Why U.S. Buyers Are Moving from China to Taiwan—Now

The U.S.–Taiwan tariff alignment removes the final barrier that once pushed buyers toward China purely on cost.

Today’s reality:

-

China is cheaper only on paper

-

Taiwan is cheaper after risk, tariffs, and delays

-

INTERTECH delivers engineering depth, audit readiness, and export reliability

Start a Tariff-Smart Manufacturing Strategy

If you are evaluating alternatives to China—or reassessing Asian suppliers after recent tariff shifts—INTERTECH offers a proven, U.S.-aligned manufacturing platform.

???? Discuss your project with our engineering team

→ Contact Us