Why U.S. Buyers Are Shifting Metal and Plastic Manufacturing from China to Taiwan

Why U.S. Buyers Are Shifting Metal and Plastic Manufacturing from China to Taiwan

Why U.S. Buyers Are Shifting Metal and Plastic Manufacturing from China to Taiwan

INTERTECH’s Tariff Advantage in a Post–U.S.–Taiwan Trade Agreement Era

For U.S. companies sourcing metal fabrication and plastic injection molding, global trade policy is no longer a background issue—it directly affects landed cost, supply continuity, and compliance risk.

With the newly finalized U.S.–Taiwan trade agreement, Taiwan now offers one of the most stable and competitive manufacturing environments in Asia, especially when compared with China and tariff-exposed Southeast Asian countries.

This shift creates a clear opportunity for U.S. buyers to reduce risk without sacrificing quality or scalability—and that’s where INTERTECH stands out.

1. What the U.S.–Taiwan Tariff Reduction Means for Buyers

The U.S. Department of Commerce has confirmed that Taiwan’s reciprocal tariff rate to the U.S. has been reduced from 20% to 15%, aligning Taiwan with Japan and South Korea.

For U.S. importers of:

-

Injection-molded plastic parts

-

Precision metal components

-

Industrial assemblies

this change delivers immediate pricing stability and removes the cost disadvantage Taiwan previously faced.

More importantly, it eliminates uncertainty—something China-based sourcing can no longer guarantee.

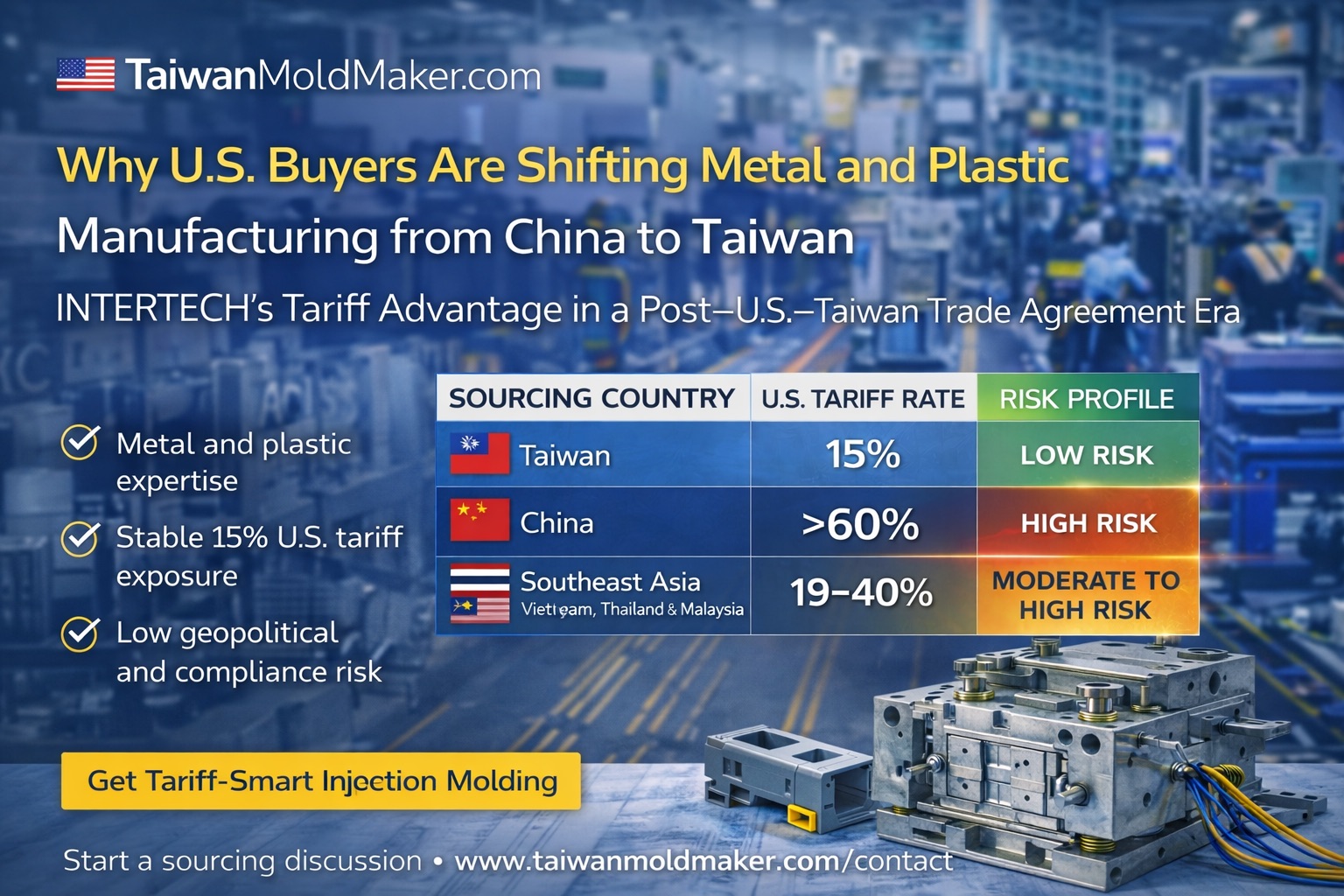

2. Taiwan vs. China vs. Southeast Asia: A Buyer-Focused Comparison

| Sourcing Country | Effective U.S. Tariff Exposure | Key Buyer Risk |

|---|---|---|

| Taiwan | 15% (negotiated & stable) | Low geopolitical & compliance risk |

| Japan / Korea | 15% | Higher tooling & labor costs |

| Vietnam | 20% (up to 40% if transshipment) | Customs scrutiny, origin risk |

| Thailand / Malaysia | 19–20% | Limited policy leverage |

| China | 60%+ (301, 232, sanctions) | Severe tariff & enforcement risk |

China’s tariffs are not just higher—they are politically volatile, subject to sudden enforcement, and often combined with customs audits, sanctions, and supply-chain disruptions.

Taiwan, by contrast, is now a policy-aligned, rules-based sourcing partner for the U.S. market.

3. Why INTERTECH Benefits Directly from Taiwan’s Position

INTERTECH operates within Taiwan’s advanced manufacturing ecosystem, allowing U.S. buyers to access:

-

Stable 15% tariff exposure

-

Transparent country-of-origin compliance

-

Zero transshipment or “origin washing” risk

-

Strong IP protection and contract enforceability

Explore INTERTECH’s core capabilities:

4. Metal and Plastic Manufacturing: Where U.S. Buyers Gain the Most

Plastic Injection Molding

Most plastic industrial parts fall under the 15% tariff bracket, restoring Taiwan’s competitiveness against Japan and Korea—without their higher cost base.

INTERTECH supports:

-

Industrial plastic housings

-

Structural plastic components

-

Automotive and machinery plastic parts

Metal Processing and Fabrication

While basic metals remain affected by separate U.S. steel and aluminum rules, precision metal components, assemblies, and tooling benefit from:

-

Predictable tariffs

-

Stable export procedures

-

Lower risk of sudden policy escalation

For U.S. buyers, this means fewer supply interruptions and more reliable costing models.

5. Total Cost of Ownership: Why Taiwan Wins on Finance and Risk

U.S. procurement teams increasingly evaluate sourcing decisions on:

-

Landed cost consistency

-

Risk-adjusted ROI

-

Long-term supplier reliability

China’s low unit pricing is often offset by:

-

Tariff spikes

-

Tool relocation costs

-

Compliance delays

-

Emergency logistics expenses

Taiwan-based manufacturing with INTERTECH delivers lower volatility, which directly improves:

-

Margin protection

-

Forecast accuracy

-

Inventory planning

6. A Supply Chain Built for U.S. Compliance

INTERTECH supports U.S. buyers with:

-

Audit-ready documentation

-

Stable production scheduling

-

Engineering-driven DFM and tooling control

-

Export-ready logistics

See real programs delivered for global buyers:

7. Why U.S. Buyers Are Moving Now

The U.S.–Taiwan tariff alignment removes the final barrier that once pushed buyers toward higher-risk regions.

Today’s reality:

-

China = high tariff, high risk

-

Southeast Asia = origin scrutiny, instability

-

Taiwan = predictable cost, stable policy, strong engineering

INTERTECH enables U.S. companies to future-proof their metal and plastic supply chains—without sacrificing quality, speed, or scalability.

Start a Tariff-Smart Sourcing Strategy

If you are sourcing metal or plastic manufacturing services for the U.S. market, now is the time to reassess your supplier strategy.

???? Contact INTERTECH to discuss your project

https://www.taiwanmoldmaker.com/contact