Manufacture in Taiwan with Lower U.S. Tariffs

Manufacture in Taiwan with Lower U.S. Tariffs

Manufacture in Taiwan with Lower U.S. Tariffs

Stable Supply. Competitive Landed Cost. Engineering-Driven Injection Molding.

U.S. import tariffs reduced to 15% • Parity with Japan & Korea • Built for long-term OEM programs

The newly finalized Taiwan–U.S. Trade Agreement has reduced U.S. import tariffs on Taiwanese products from 20% to 15%, restoring competitive parity with Japan and South Korea.

For U.S. companies sourcing plastic injection molded parts, tooling, and industrial components, this change delivers something critical:

cost predictability without sacrificing engineering quality or supply reliability.

At TaiwanMoldMaker.com, we help U.S. buyers convert this policy shift into measurable manufacturing advantage.

Why U.S. Buyers Are Re-Evaluating Taiwan Now

For the past year, elevated tariffs distorted sourcing decisions. That uncertainty is now removed.

What’s changed:

-

✔ Tariffs capped at 15%, aligned with Japan & Korea

-

✔ Taiwan recognized as a core U.S. supply-chain partner

-

✔ Reduced risk of sudden duty escalation

-

✔ Renewed RFQ activity across industrial and plastics sectors

This is not a short-term incentive—it’s a structural reset.

What This Means for Your Plastic Injection Molding Program

Predictable landed cost

With tariffs finalized, you can lock pricing, approve tooling, and plan multi-year programs without contingency buffers inflating cost.

Engineering value back in focus

Supplier selection can return to what actually matters:

-

Mold quality

-

Part consistency

-

Lead-time reliability

-

Process control

Lower total cost of ownership

A 15% tariff on a well-engineered, low-defect part is often more economical than a higher-risk, lower-capability alternative.

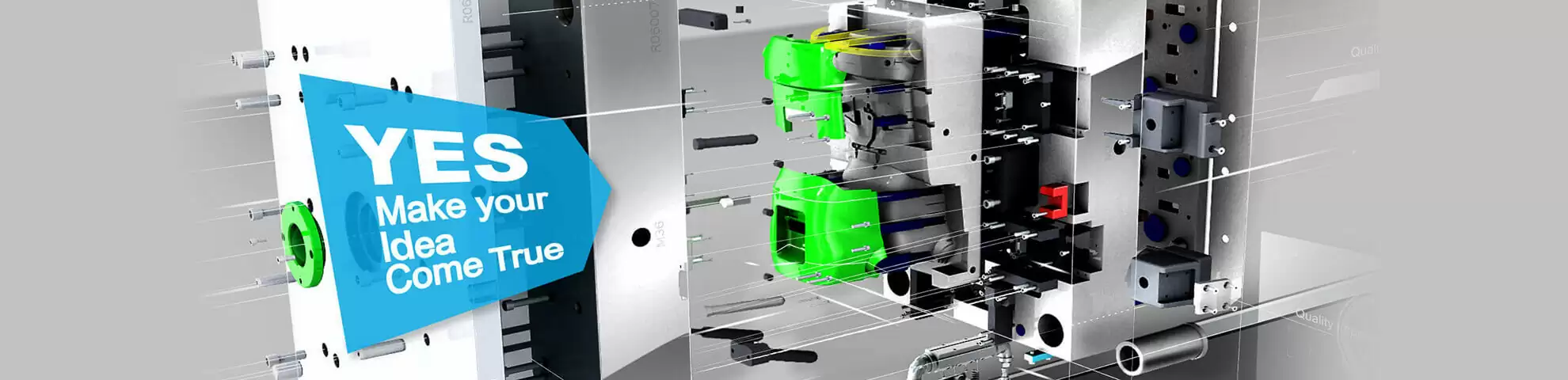

INTERTECH Manufacturing Advantage (via TaiwanMoldMaker.com)

INTERTECH is part of the TaiwanMoldMaker.com manufacturing network, supporting U.S. buyers with end-to-end plastic injection molding capability.

1. Design & DFM collaboration

We help optimize parts before steel is cut—reducing tooling changes and cycle-time risk.

2. Reliable tooling under real timelines

In-house mold development with defined milestones (T0 / T1 / SOP), not vague estimates.

→ Mold Service

→ Injection Mold

3. Scalable molding for U.S. programs

From pilot runs to mass production, our molding operations support consistent output and export-ready workflows.

→ Molding

Product Categories Best Suited for the 15% Tariff Framework

U.S. buyers are actively sourcing Taiwan for:

-

Plastic injection molded components

-

Industrial housings and enclosures

-

Automotive aftermarket plastic parts

-

Construction and infrastructure accessories

-

Electrical and power-related plastic components

You can view representative programs here:

→ Customer Examples

Why Not “Lowest Cost” Countries?

Some regions still face:

-

Higher or volatile tariffs

-

Transshipment scrutiny

-

Longer lead times

-

Quality inconsistency

Taiwan offers a different model:

stable policy alignment + high engineering density + predictable execution.

That combination matters more than nominal unit price.

What U.S. Buyers Typically Ask Us

Can you support long-term supply, not just tooling?

Yes. We plan capacity and production around ongoing OEM demand.

Do you support U.S. quality and documentation expectations?

Yes. Our processes are built for export programs with traceability and repeatability.

Is Taiwan still competitive after tariffs?

At 15%, Taiwan is competitive because defects, delays, and redesigns cost more than duties.

Start a Tariff-Resilient Manufacturing Program

If you are reassessing suppliers under the new Taiwan–U.S. tariff structure, we invite you to start with a technical discussion—not a sales pitch.

???? Contact our engineering team:

https://www.taiwanmoldmaker.com/contact

Build in Taiwan. Ship to the U.S. with Confidence.

Engineering-driven plastics manufacturing.

Predictable tariffs.

Stable supply for long-term programs.